Our Plan for

-

HealthcareThe changes to Healthcare

HealthcareThe changes to Healthcare -

WelfareThe difference to Welfare

WelfareThe difference to Welfare -

TaxesSimplify filing of Taxes

TaxesSimplify filing of Taxes -

RetirementA better plan for Retirement

RetirementA better plan for Retirement -

Q & A HelpCheck our Q & A

Q & A HelpCheck our Q & A

How Circulatory Spending works

The Circulatory Spending Model is now neatly in order and ready for view. So get your thinking caps on and see how this new system will work. Now let's start with the tax parameters then where the money is going and what will be done with the money.

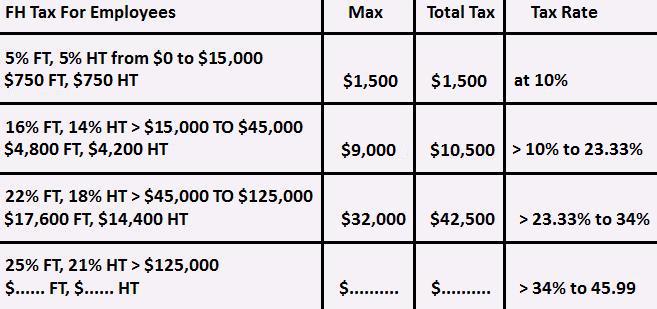

What Circulatory spending does is seperates what taxes the employee pays vs what the employer pays. Employer includes governments as well. The employee will be responsible for paying an income tax while the employer puts money into a personal account for employee use. That means each will have their own tax code to follow. The old Federal tax(FT) is replaced with a 4 bracket system for the federal government. Here is the new Federal Healthcare Tax that will be known as the FHT from the employee would pay;

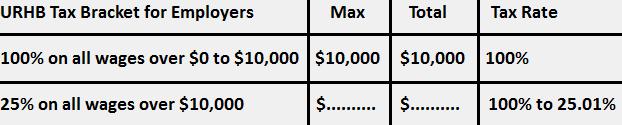

No deductions, credits or additional exemptions of any kind. Tips will be taxed as normal income using the new scale above. No more tax returns and you will see why a little later. Filing taxes will be a one page job for employees. Now here is the universal payroll tax code for all employers and corporations into a Universal Riterment Healthcare Account(URHA) for employees.

The tax for the employer and corporations represents paying all of your employees $7,500 for healthcare, dental and vision, 3% for disability, 4% for sick leave, 3% for unemployment and 15% for retirement. In return the employer will pay no federal, state, city and county income taxes or corporate taxes, the old 7.65% payroll tax per employee is gone, no property taxes on employers buildings that conduct normal business, no Gross Receipts Tax, no unemployment tax, no Workers' Compensation insurance directly, no franchise or margin tax, no paying for any health insurance directly or life insurance and no disability insurance and save money on doing taxes. They will also end any pensions and stop paying into 401k's as well. Cut any other taxes and fees that is possible to cut for the employer as well. People who own businesses who have employees other than their immediate family would just pay one tax to their employees and not have to worry about certain benefits any more.

If an employer is leasing a building to conduct normal business in then the person who owns the land and or property would not have to pay property taxes on that building. The owner of the land will be obligated to pass on the savings to the employer on their lease agreements. If a person owns a business property and is not conducting normal business with employees or not leasing to an employer that is then the property owner would have to pay the property tax until they sell the property or get it leased. They can always sell to the city so the city can find someone to conduct business at that location.

Under Circulatory Spending corporation and business owners will be made responsible for all of their workers. Even if a company contracts employees the contractor will still be bound by the same tax laws for their employees which would mean that the company would be paying a little more than if they hired them directly. There will be no reclassifying of employees by calling them "partners","on-demand workers", "independent contractor" or "contract workers" or any other name or newly created classifications to avoid paying the universal tax.

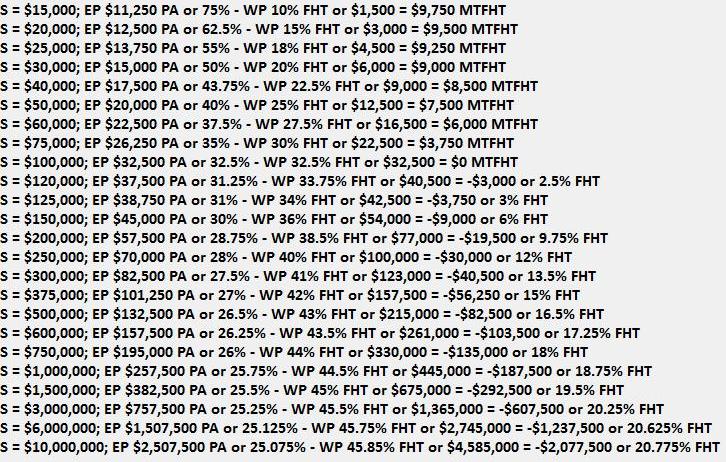

For the employee this means that every single employee is going to save money in a personal universal account. This also means that every employee will see their taxes cut without the need of any sort of tax return system at any level of government. Every employee who makes less than $100,000 a year will get back more than what they paid in to the new tax while higher wage workers will see their taxes cut but evenually see their taxes erased over time. Here are some examples for a year; S = Salary, EP = Employer Pays, PA = Personal Account, WP = Worker Pays, FHT = Federal Healthcare Taxes, MTFHT = More Than Federal Healthcare Taxes

As you can see with the tax and benefits going to the employee this erases a lot of the taxes that the employee pays while the tax that the employee pays is still progressive. Keep in mind that when you factor in state and local taxes the $0 at the $100,000 mark will vary. For example, if you live in a state that has a flat tax of 3.00%, city tax of 1.50% and county tax of 0.50% then that areas $0 mark would be at $75,000. Because your employer is feeding money back to you in your account there would be no need for a tax return system for any government branch. With this tax to pay for the employer this represents a healthcare plan without all of the Affordable care Act taxes and regulation, a retirement plan that carries no unfunded liability issues, no more uncertainty about what taxes are from city to city or state to state since this is universal it puts every business on an even playing field with no company getting more tax breaks than the other.

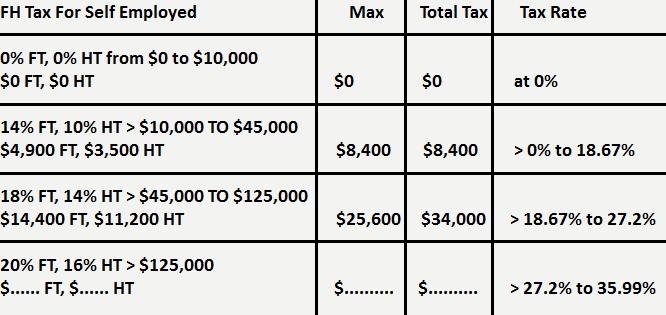

Self employed and sole proprietors will use a different tax plan plus they will use a much simplier form with some standard deductions and exemptions with a tax break of around 20%. This tax is lower since there is no employer to erase their taxes the self employed will deposit 20%, no cap on income, into their own account for savings. They will be able to deduct the portion they pay into their account from taxable income. More on how it works on the taxes page later. Here is what the brackets look like.

The money the employer pays to the employee will be placed in an Universal Retirement Healthcare Bank(URHB) that will replace the Federal Reserve so investment firms and other new businesses and so on can borrow and pay back with interest. What the employer pays goes into your personal Social Security account within the bank and what the employee pays in the combined taxes goes to the URHB for Healthcare and the all the governments. The URHB will also make a profit a little differently. Start by removing the social security payroll tax from the tax code. The URHB will take over all loans that the government was making like student loans, housing, and loans for businesses, agriculture, disaster relief, veteran and financing healthcare as well. More on that on the healthcare page. The federal government will not be in the loan business any more. Since this is not a traditional bank private banks will handle all your checking and debit cards like normal. With the money building up in your URHB this creates a second source of collateral along with your house or car. Since withdraws can be made from your URHB account it would make it easier to pay back these loans to private banks.

There will also be a bank interest tax imposed by the URHB of 50% that also goes towards profit. Private banks will collect the money and send it directly to the URHB. Customers will see this on their monthly financial statements. For example, if your account had gained $5 of interest this month then you would see something like ($5 - 50% URHBT = $2.50 Interest). In return private bank regulations will be dropped allowing banks to invest in the stock market to give customers a higher rate of interest.

End the Estate tax at the federal and estate and or inheritance tax state level. End tax breaks for Dynasty Trusts and GRATs. Replace it with a URHB Inheritance Tax(URHBIT) that taxes inheritance as income with a $2,000,000 exemption that goes towards the profit of the URHB. The beneficiary will be responsible for paying the tax once the executor of the estate distributes the assets to each person. The rate of tax would look like this;

0% to heir from $0 to $2,000,000

20% to heir over $2,000,000 to $5,000,000

$600,000 plus 35% to heir over $5,000,000

The property would be valued at its market value on the date of death of the decedent. Property transfers between spouses or civil partners (not between unmarried partners) are exempt. Property passing to children (biological and legally-adopted children), stepchildren, grandchildren, great-grandchildren, and other lineal descendants as well as property passing to parents, grandparents, great-grandparents, and other lineal ascendants is exempt from inheritance tax. Property to all other beneficiaries are taxed on the entire share passing to them from the estate. You can give $14,000 to as many individuals as you want each year without worrying about the URHB inheritance tax. So if a child inherites $8,000,000 plus $5,000,000 of farm land the farm land would be exempted from the inheritance tax but not exempt is the $8,000,000. This person would pay 35% on $3,000,000 plus $600,000 so the tax would be $1,650,000 to the URHB as profit. That comes out to a 20.625% URHBIT on that portion of money.

The FDIC will be eliminated and so would traditional private banking. The URHB will take over all loans present and future that was made by the Federal government. The URHB will be fully insured by the Federal Treasury department with debt free treasury notes. Private banks will need to carry private insurance to cover at least $100,000 per account holder. If a person want more of their money covered against failure the bank can work with insurance companies to charge a small fee based on the amount you want covered or account holders can just simply spread their money to other banks. For example, a person could buy account insurance that covers 50%, 60%, 75%, 80% or even 100% of any portion over $100,000 in their account. The insurance companies would then offer rates through exchanges and the customer would pick the best rate that matches what the customer wants. Private insurance will do a much better job keeping the banks from taking to many unnesessary risks since they will be fully on the hook if a bank fails.

Since private banks will no longer need to borrow money from a Federal Reserve, since it will not exist, the URHB will supply them with plenty of money as people make withdraws from their URHB accounts. Everytime someone makes a withdraw from the URHB that money will be directly deposited to that persons private bank account. The interest from private banks will be set by the free market on all checking accounts and savings accounts. They could have options like either you have a savings account set up and banks will invest that money and offer their customers a flat rate interest rate or offer you a higher interest rate based on how much you keep in to your account. You could also buy various stocks, bonds and mutual funds and so forth to set up your own personal investment private investment banks.

The URHB will be created by removing Social Security and Medicare from the federal budget and merging them to form the bank. The Federal Reserve will be eliminated and the people of the Federal Reserve can be used to run the URHB. Repeal the "Federal Reserve Act of 1913" and the "National Banking act of 1864. This move will also allow the U.S.A. to withdraw from the BIS/IMF/World Bank global equivalent of the Fed. Currency exchange can be accomplished nationally. They will take that money and be incharge of loans that normally the federal government would handle to create jobs in America. Any loans made to other countries must first be approved by the federal government. Interest of 6% will be guaranteed to all personal account holders and never be lower or raised once all revenue sources are put in place. Since the Treasuries job is to make sure the bank is profitable the payments and withdraws of retirement and healthcare will be handled by Social Security and Medicare. Medicaid, Chip, VA and Department of Health and Human Services will all become part of the new Healthcare system. While some employees from Unemployent, Hud and Welfare will join Social Security which will become a personal social Security plus system. This means no need for pensions as well. The people will be allow to withdraw from their account as early as age 18.

The government programs just mentioned will be taken off the federal, state and city budgets and become part of the URHB. From there these governments can hire some of these people to work in areas that need more help has we start the process of moving people off of these programs and using their own account. This way hardly any jobs will be lost just reassigned to other government agencies to be retrained. By taking these programs of the books this will free up more money for the various governments to deal will other issues. This means more money for schools, roads and bridges, police and fire fighters, boarder patrol, immigration and so forth.

What happens is Congress and the President will fade away any and all unneeded government programs. Then they will put together a budget for the federal government. The federal government still has it's excise taxes, capital gains, estate and miscellaneous taxes. Adding the new income tax on the employee only this should give the federal goverenment around $1.5 trillion or more based on compliance. The URHB can pay off the countries the U.S. borrowed money with dedt free treasury notes. Any other outstanding loans that was given out by the Federal Reserve will be paid back to the URHB. Money from the URHB will also be loaned out and invested in all types of projects that will gain interest for everyones account. Student loans will come from the URHB as well.

The advantage of the URHB is that it regulates the amount of money that has been created and make sure that the money trickles down to everyone that works. It also let's the people control the amount of money that is released and lets them decide how and where the money is spent. The only bank that is too big to fail will become the URHB. The URHB is job to keep America at full employment by supplying the loans necessary to create new jobs, businesses and investments as well as supplying very low interest loans to states and local governments to rebuild our infrastructure. The people will be incharge of growing the market as they make withdraws from their account purchase their own needs and set up their own private investments if they choose.

The new URHB will answer to the President and all fifty Governors as well as the American people. The URHB will be under regular audits to make sure that the profits are being applied to everyones account and bills are being paid and loans are being paid back. They will also discuss how payments to the old pension systems will be handled. All pensions whether public or private should be consolidated down to one Universal Retirement Healthcare Bank that is open for all residences of the U.S.A. By merging every pension into one bank style pension system all the investment pension funds that the cities and states and the federal government uses will all be working together to grow and invest the pot of money. Everyone who paid into a pension will get credit for what they paid and it will be added to your personal account. Each city will have a bank branch just in case you may need to change what bank account your money will go to or signing up for healthcare and deal with any other concerns you may have. Your Social Security office and or Medicare office can serve as your branch. If more branches are needed in remote locations then some U.S. Post Offices can serve as branches.

Before we make this switch to the new system there will be a vote to see if America thinks this is the proper way to pay back the money from Social Security, Medicare and pensions. If the peolple vote yes then that portion of the deficit will be considered paid off and the only portion left is what is owed to other countries. Since the Federal Reserve would be abolished and replaced with the URHB the federal government would not owe them anything either. That will drop our deficit by over 3/4 with the other less than 1/4 being paid back by the Federal government to the countries the U.S. borrowed money from over the years.

Additional taxes would look like this;

* Long-term gains and qualified dividends after one year taxed at flat tax of 15% FT, 10% HT

* Short term capital gains less than one year a flat rate of 25% FT, 10% HT

* Flat tax 12% FT, 8% HT on Collectibles.

* 12% FT, 8% HT on qualified small business stock with current exclusion using federal rules.

* 16% FT, 14% HT on monthly payments from URHB after death.

* Lottery and Gambling tax 12% FT and 8% HT after $5,000 of winnings per year.

* Accumulated Earnings tax 40% FT over $250,000 C corportations ($150,000 for Personal Service Corporation).

* Foreign Account Tax Compliance Act 30% FT.

* No Depreciation Recapture.

* No government tax on private bank interest.

* No Alternative Minimum Tax.

* No Net Investment Income Tax.

No deductions on long term capital gains and dividends of any kind. They already enjoy a hugh tax break since they are not getting taxed twice at the profit level by the federal government. Minimum witholding rate under flat rate method on supplemental wages will be taxed as normal income whether it is commissions, bonuses, tips, severance pay, overtime pay, unused vacation or sick days, awards, back pay or retroactive pay. States and local government can apply what ever tax they need for their needs.

The employer would also see a new federal minimum wage scale. If an employer hire someone 20 and older they must start them out at no less than $9.25h. For tipped workers it's $7.40h. Tipped worker minimum wage is set at 80% of the hourly minimum wage and the employer must make up the difference if tips do not cover the difference between the hourly minimum wage. For young people under age 20 an employer can start them out at $7.25h or $5.80h for tipped workers for 4 consecutive weeks for training then a raise to $8.00h or $6.40h for tipped workers between week 5 to week 8 then a raise to $8.75h or $7.00h for tipped workers between week 9 to week 12. On or by week 13 or at age 20, which ever comes first, the employee must be at least at $9.25h or $7.40h for tipped workers. From that point on what ever raise the employee gets is based on that employers own rules.

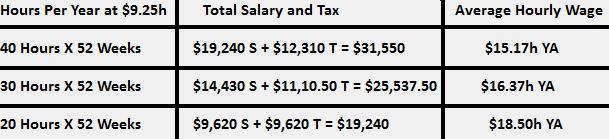

For employee minimal wage is actually $15.17h for the year if that person worked 40 hours per week since only the first $10,000 of salary is taxed at 100%. This also means it is cheaper per hour for an employer to give their employees more hours than it is less hours. Take a look at this example of an employees wages of $10.00h if you were working full time or part time; S = Salary, T = Tax, YA = Yearly Average

A new employee will have strong incentive to work hard so the employer will have good reason to keep them on and at the same time it gives employers a chance to hire and train a young person with no work history or skill for that job title and see how they are going to work out before they pay them more money. Another advantage for the employee is that since there is no tax on the payroll tax that means you get to keep more of your money and use it now instead of waiting until you are 65 unlike with the old social security.

There will also be a raise in the overtime threshold to $50,000 for salaried workers but a change to the rate of pay. The employer must either pay a salaried worker for all hours worked over 40 hours at time and a half pay or allow employee to take time off at a later date based on hours worked per quarter. Compensation must be dished out over the next quarter to salaried employee. The employer and employee could keep track of the time past 40 hours worked then decide if you want to either be paid for all the time worked or days off or even a combination of both. So if a salaried employee worked a total of 80 hours above their normal shift the employer could pay an employee 40 hours at regular time added to their pay then give the employee 40 hours of time off over the next quarter. The employee's salary must stay the same while the time is given. The employee will decide which is best for them.

There will be a universal paid holiday schedule in place which consist of New Year's Day, Martin Luther King Jr. Birthday, Washington's Birthday, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day. If you average;

* 20 hours of less you get 4 hours pay above scheduled hours

* 21 to 31 hours earns 6 hours of pay above scheduled hours

* Over 31 hours earn 8 hours pay above scheduled hours.

These days are the same the federal workers receive. If you work on those days you will be paid at time and a half along with the additional hours at regular rate added to your account as well. Example would be that if someone working 40 hours worked on Independence day then that person would be paid for 32 hours at regular pay + 8 hour time and a half + 8 hours for holiday pay at regular pay. If an employee worked 32 hours that week then they would get paid for 24 hours at regular pay + 8 hour time and a half + 8 hours for holiday pay at regular pay.

All businessses will be required to set up some type of vacation time for full and part-time employees. There will be no set vacation plan by the government for private businesses so businesses can freely set up what kind of vacation plan works best for their company as long as it does not discriminate in any way shape or form.

Paternity leave, maternity leave, sick leave and parental leave will be granted by employers based on employers and employees needs. Every employee will be eligible for up to a total of 12 weeks of paid leave. During that time off the employer would not be obligated to pay for the time off and does not have to put money into their account. The money that is already in your account is more than efficient to cover that time off when needed. See the examples below of how an employee can withdraw their money out later as you keep reading. The employee need to have 6 months in to qualify. Paid leave can be to care for a new child, take care of adoption proceedings or for the placement of a foster child in their home and caring for a seriously ill family member.

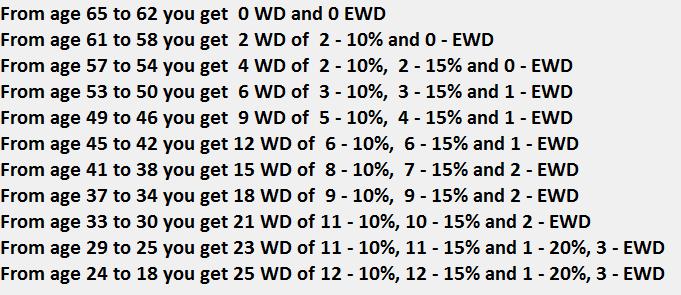

This account is not just a retirement account. This is also your, Medicaid, Medicare, welfare, food stamps, unemployment, HUD, stimulus, grants, vouchers, subsidies and more. If you are under 65 and are using any of these programs then you will be taken off and you will use your account from this point on to take care of your need. Certain programs may still be available for people 65 and older if a raise in Social Securty can't cover it but they will be the last generation to use these services. Everyone will get 12 life time withdraws of 10% and 12 withdraws of 15% and 1 withdraw of 20% for a total of 25 withdraws for people 24 years of age to 18 then will be scaled down by age to get started. You can only make a withdraw once within a calendar year. You will use these withdraws instead of getting unemployment checks, welfare, food stamps, HUD or Medicaid. You can also use these withdraws how ever you like but keep in mind that once you use them up then that is it. You will get 3 emergency withdraws. When you cash one in this will allow you to make a second withdraw within a calendar in case something goes wrong after you have used one of your withdraws. Phase in for withdraws will work like this; WD = Withdraws, EWD = Emergency Withdraws

To start everyone will get credit for what they paid in to Social Security and Medicare as well as any pension you were paying in at work whether public or private if you are under the age 65 and are not already collecting social security or a pension. That money will be added to your personal account within the URHB. From that point on your employer or you if you are self employeed will be adding money into your account and that money will gain 6% compounded monthly interest rate. You will have to show picture ID in order to make any withdraws from your account.

At age 65 what is left over would be converted into a monthly payment. Your payments will be based over a 55 year or 660 months to be exactly, with the 6% compounded monthly interest rate still being applied to your account. That means your account will not run out of money until you are 120 years old so you will never have to worry about out living your money when you retire. Your monthly payments depend on how long you worked and how long you have been on the new system and how you use your withdraws. People between the ages of 50 to 62 can see how much they would get from the old social security account and compare it to the new system to see which one is best for you. Best efforts will be made to ensure you get fair monthly payment at age 65.

The URHB will be a tax free zone while you are alive. There will never be a direct tax levied by the federal, state, county and city or town government on the money that goes into your account, withdraws made from your account and monthly payment at age 65. Only the URHB monthly fees on accounts will be levied. Since the URHB will be paying the old Social Security payments any direct tax levied on the payments will remain the same. This basically make the URHB a tax haven for all working Americans. Only after death will a FHT will be taken out. States, cities abd counties can also have a tax in place if they choose. People who are currently on the old Social Security system will get a one time 5% raise to help off set past low cost of living increases. How you get your money will stay exactly the same as it does currently. Take a look at these examples below. Please keep in mind that these examples include sample insurance rates being deducted from your account. More on that on the healthcare page at the end.

Example 1 with withdraws and healthcare credit being deducted from age 21 year on up.

A part time kid working off and on from 16 age to age 18 before interest would have saved $20,000. At age 18 this person worked for 47 years and earned a salary of $26,000 per year for 8 years earning $14,000 per year into their account. Then $35,000 a year earning $16,250 for 10 years. Then $40,000 earning $17,500 for 15 years. Then $45,000 earning $18,750 for 14 years. This persons various healthcare credit payment deducted and $10 a month bank fee from their account added up to $4,392 per year or $366 per month. Using a savings calculator with an annual interest rate of 6% you can follow how this person could have withdrawn their money throughout the course of their life. YIRCM = Yearly Interest Rate Compounded Monthly DD = Direct Deposit

1. Age 18 after 2 years of interest of 6% withdraws from new total;$21,194.34 - 15%[$3,179.15 DD] Balance = $18,015.19 + One year later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $29,003.04.

2. Age 19 withdraw;$29,003.04 - 10%[$2,900.30 DD] Balance = $26,102.74 + One year later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $37,589.41.

3. Age 20 withdraw;$37,589.41 - 10%[$3,758.94 DD] Balance = $33,830.47 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $58,494.95.

4. Age 22 withdraw;$58,494.95 - 15%[$8,774.24 DD] Balance = $49,720.71 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $76,405.79.

5. Age 24 withdraw;$76,405.79 - 10%[$7,640.58 DD] Balance = $68,765.21 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $97,871.98.

6. Age 26 withdraw;$97,871.98 - 15%[$14,680.80 DD] Balance = $83,191.18 + Two years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $118,900.85.

7. Age 28 withdraw;$118,900.85 - 10%[$11,890.09 DD] Balance = $107,010.77 + One years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $125,800.59.

8. Age 29 withdraw;$125,800.59 - 15%[$18,870.09 DD] Balance = $106,930.50 + Two years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $145,658.85.

9. Age 31 withdraw;$145,658.85 - 15%[$21,848.83 DD] Balance = $123,810.02 + Two years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $164,684.77.

10. Age 33 withdraw;$164,684.77 - 10%[$16,468.48 DD] Balance = $148,216.29 + One year later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $169,547.58.

11. Age 34 withdraw;$169,547.58 - 10%[$16,954.76 DD] Balance = $152,592.82 + Two years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $197,127.58.

12. Age 36 withdraw;$197,127.58 - 15%[$29,569.14 DD] Balance = $167,558.44 + Two years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $216,645.22.

13. Age 38 withdraw;$216,645.22 - 10%[$21,664.52 DD] Balance = $194,980.70 + Two years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $247,554.49.

14. Age 40 withdraw;$247,554.49 - 10%[$24,755.45 DD] Balance = $222,799.04 + Four years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $342,156.45.

15. Age 44 withdraw;$342,156.45 - 15%[$51,323.47 DD] Balance = $290,832.98 + Two years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $355,595.32.

16. Age 46 withdraw;$355,595.32 - 10%[$35,559.53 DD] Balance = $320,035.79 + Five year later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $507,892.22.

17. Age 51 withdraw;$507,892.22 - 10%[$50,789.22 DD] Balance = $457,103.00 + Two year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $545,657.45.

18. Age 53 withdraw;$545,657.45 - 15%[$81,848.62 DD] Balance = $463,808.83 + Four years later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $653,992.15.

19. Age 57 withdraw;$653,992.15 - 15%[$98,098.82 DD] Balance = $555,893.33 + Two years later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $657,009.94.

20. Age 59 withdraw;$657,009.94 - 15%[$98,551.49 DD] Balance = $558,458.45 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $607,662.45.

21. Age 60 withdraw;$607,662.45 - 10%[$60,766.25 DD] Balance = $546,896.21 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $595,387.07.

22. Age 61 withdraw;$595,387.07 - 15%[$89,308.06 DD] Balance = $506,079.01 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $552,052.36.

23. Age 62 withdraw;$552,052.36 - 10%[$55,205.24 DD] Balance = $496,847.12 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $542,251.06.

24. Age 63 withdraw;$542,251.06 - 15%[$81,337.66 DD] Balance = $460,913.40 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $504,101.03.

25. Age 64 withdraw;$504,101.03 - 20%[$100,820.21 DD] Balance = $403,280.82 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $442,913.80.

26. This person now has $442,913.80 at age 65. Keep in mind that your money will stay in the bank continuing to gain that 6% interest past age 65. Over a 55 year period using a retirement calculator you would be able to get 659 Monthly withdrawals in the amount of $2,295.05 and one final withdrawal of $2,329.99. We are not done yet. This person stll have their various insurance and healthcare credit policies from their account if they choose to have them plus a bank fee(BF).

So $2,295.05 - $366[healthcare credit] - $10[BF] = $1,919.05 per month or $23,028.60 a year. With an average salary of $38,042.55 your monthly payment would be about 60.53% of this person's average salary. If you paid a lump sum for your healthcare credit then you would get $2,295.05 - $10[BF] = $2,285.05 per month or $27,420.60 a year. That would be about 72.08% of your average salary.

All 25 withdraws from the age of 18 to 65 added up to $1,006,563.94. If you average that out over the 47 year period that comes up to $21,416.25 per year. Factor in your average salary of $38,042.55 a year and it is like you are averaging $59,458.80 per year or 156.3% your average salary and you still have money left over for a monthly payment at age 65. Without the URHB interest the employer's total payment over the course of this person's life would have been $819,500 with no monthly payment at age 65.

Example 2 - Working til age 65 using just 12 of their withdraws with the same wage parameters as Example 1.

1. Age 18 after 2 years of interest of 6% withdraws from new total;$21,194.34 - 15%[$3,179.15 DD] Balance = $18,015.19 + One year later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $29,003.04.

2. Age 19 withdraw;$29,003.04 - 10%[$2,900.30 DD] Balance = $26,102.74 + One year later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $37,589.41.

3. Age 20 withdraw;$37,589.41 - 10%[$3,758.94 DD] Balance = $33,830.47 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $58,494.95.

4. Age 22 withdraw;$58,494.95 - 15%[$8,774.24 DD] Balance = $49,720.71 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $76,405.79.

5. Age 24 withdraw;$76,405.79 - 10%[$7,640.58 DD] Balance = $68,765.21 + Two years later;Added $800.67 per month with total gaining 6% YIRCM = New balance of $97,871.98.

6. Age 26 withdraw;$97,871.98 - 10%[$9,787.20 DD] Balance = $88,084.78 + Five years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $187,757.82.

7. Age 31 withdraw;$187,757.82 - 10%[$18,775.78 DD] Balance = $168,982.04 + Five years later;Added $988.17 per month with total gaining 6% YIRCM = New balance of $296,876.10.

8. Age 36 withdraw;$296,876.10 - 15%[$44,531.42 DD] Balance = $252,344.69 + Eight years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $541,489.64.

9. Age 44 withdraw;$541,489.64 - 15%[$81,223.45 DD] Balance = $460,266.19 + Seven years later;Added $1,092.33 per month with total gaining 6% YIRCM = New balance of $813,457.81.

10. Age 51 withdraw;$813,457.81 - 15%[$122,018.67 DD] Balance = $691,439.14 + Twelve years later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $1,669,414.05.

11. Age 63 withdraw;$1,669,414.05 - 15%[$250,412.11 DD] Balance = $1,419,001.94 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $1,521,282.38.

12. Age 64 withdraw;$1,521,282.38 - 20%[$304,256.48 DD] Balance = $1,217,025.90 + One year later;Added $1,196.50 per month with total gaining 6% YIRCM = New balance of $1,306,848.89.

13. This person now has $1,306,848.89 at age 65. Keep in mind that your money will stay in the bank continuing to gain that 6% interest past 65. Over a 55 year period using a retirement calculator you would be able to get 659 Monthly withdrawals in the amount of $6,771.72 and one final withdrawal of $6,786.66. So $6,771.72 - $366[Insurances] - $10[BF] = $6,395.72 per month or $76,748.64 a year. With an average salary of $38,042.55 your monthly payment would be about 201.74% of your average salary. If you paid a lump sum for your healthcare credit then you get $6,771.72 - $10[BF] = $6,761.72 per month or $81,140.64 a year. That would be about 213.29% of your average salary.

All 12 withdraws from the age of 18 to 65 added up to $857,258.32. If you average that out over the 47 year period that comes up to $18,239.54 per year. Factor in your average salary of $38,042.55 a year salary and it is like you are averaging $56,282.09 per year or 147.95% your salary and you still have money left over for a monthly payment at age 65.

Example 3 with withdraws and healthcare credit payment being deducted from age 21 year on up.

A part time kid working off and on from 16 age to age 18 before interest would have saved $19,500 in to their account. At age 18 this person went to college and graduated at age 22 while continuing to work averaging about $18,000 a year earning $12,000 per year in to their account. At age 22 graduated and found a job and earned a salary of $54,000 per year for 4 years earning $21,000 per year into their account. Then $84,000 a year earning $28,500 for 6 years. Then $138,000 earning $42,000 for 6 years. Then $234,000 earning $66,000 for 5 years. Then $354,000 earning $96,000 for 5 years. Then $714,000 earning $186,000 for 5 years. Then $894,000 earning $231,000 for 6 years. Then $1,794,000 earning $456,000 for 6 years. This persons various healthcare credit payment deducted and $10 a month bank fee from their account added up to $6,000 per year or $500 per month. Using a savings calculator with an interest rate compounded monthly of 6% you can follow how this person could have withdrawn their money throughout the course of their life. YIRCM = Yearly Interest Rate Compounded Monthly DD = Direct Deposit

1. Age 18 after 2 years of interest of 6% withdraws from new total;$20,664.59 - 15%[$3,099.69 DD] Balance = $17,564.90 + One year later;Added $1,000 per month with total gaining 6% YIRCM = New balance of $30,983.83.

2. Age 19 withdraw;$30,983.83 - 10%[$3,098.38 DD] Balance = $27,885.45 + One year later;Added $1,000 per month with total gaining 6% YIRCM = New balance of $41,940.93.

3. Age 20 withdraw;$41,940.93 - 10%[$4,194.09 DD] Balance = $37,746.84 + Two years later;Added $1,000 per month with total gaining 6% YIRCM = New balance of $67,978.67.

4. Age 22 withdraw;$67,978.67 - 15%[$10,196.80 DD] Balance = $57,781.87 + Two years later;Added $1,250 per month with total gaining 6% YIRCM = New balance of $96,919.34.

5. Age 24 withdraw;$96,919.34 - 10%[$9,691.93 DD] Balance = $87,227.41 + Two years later;Added $1,250 per month with total gaining 6% YIRCM = New balance of $130,109.17.

6. Age 26 withdraw;$130,109.17 - 15%[$19,516.38 DD] Balance = $110,592.79 + Two years later;Added $1,875 per month with total gaining 6% YIRCM = New balance of $172,340.66.

7. Age 28 withdraw;$172,340.66 - 10%[$17,234.07 DD] Balance = $155,106.59 + One year later;Added $1,875 per month with total gaining 6% YIRCM = New balance of $187,802.40.

8. Age 29 withdraw;$187,802.40 - 15%[$28,170.36 DD] Balance = $159,632.04 + Two years later;Added $1,875 per month with total gaining 6% YIRCM = New balance of $227,615.73.

9. Age 31 withdraw;$227,615.73 - 15%[$34,142.36 DD] Balance = $193,473.37 + One year later;Added $1,875 per month with total gaining 6% YIRCM = New balance of $228,535.56.

10. Age 32 withdraw;$228,535.56 - 10%[$22,853.56 DD] Balance = $205,682.00 + One year later;Added $3,000 per month with total gaining 6% YIRCM = New balance of $255,374.70.

11. Age 33 withdraw;$255,374.70 - 10%[$25,537.47 DD] Balance = $229,837.23 + Two years later;Added $3,000 per month with total gaining 6% YIRCM = New balance of $335,359.15.

12. Age 35 withdraw;$335,359.15 - 15%[$50,303.87 DD] Balance = $285,055.28 + Two years later;Added $3,000 per month with total gaining 6% YIRCM = New balance of $397,598.71.

13. Age 37 withdraw;$397,598.71 - 10%[$39,759.87 DD] Balance = $357,838.84 + One year later;Added $3,000 per month with total gaining 6% YIRCM = New balance of $416,916.24.

14. Age 38 withdraw;$416,916.24 - 10%[$41,691.62 DD] Balance = $375,224.62 + Four years later;Added $5,000 per month with total gaining 6% YIRCM = New balance of $747,207.97.

15. Age 42 withdraw;$747,207.97 - 15%[$112,081.20 DD] Balance = $635,126.77 + One year later;Added $5,000 per month with total gaining 6% YIRCM = New balance of $735,977.81.

16. Age 43 withdraw;$735,977.81 - 10%[$73,597.78 DD] Balance = $662,380.03 + Five year later;Added $7,500 per month with total gaining 6% YIRCM = New balance of $1,416,726.63.

17. Age 48 withdraw;$1,416,726.63 - 10%[$141,672.66 DD] Balance = $1,275,053.97 + Two year later;Added $15,000 per month with total gaining 6% YIRCM = New balance of $1,818,668.88.

18. Age 50 withdraw;$1,818,668.88 - 15%[$272,800.33 DD] Balance = $1,545,868.55 + Three years later;Added $15,000 per month with total gaining 6% YIRCM = New balance of $2,439,952.36.

19. Age 53 withdraw;$2,439,952.36 - 15%[$365,992.85 DD] Balance = $2,073,959.51 + Two years later;Added $18,750 per month with total gaining 6% YIRCM = New balance of $2,814,532.90.

20. Age 55 withdraw;$2,814,532.90 - 15%[$422,179.94 DD] Balance = $2,392,352.97 + Two years later;Added $18,750 per month with total gaining 6% YIRCM = New balance of $3,173,413.20.

21. Age 57 withdraw;$3,173,413.20 - 10%[$317,341.32 DD] Balance = $2,856,071.88 + Two years later;Added $18,750 per month with total gaining 6% YIRCM = New balance of $3,696,098.50.

22. Age 59 withdraw;$3,696,098.50 - 15%[$554,414.78 DD] Balance = $3,141,683.73 + Two years later;Added $37,500 per month with total gaining 6% YIRCM = New balance of $4,494,877.85.

23. Age 61 withdraw;$4,494,877.85 - 10%[$449,487.79 DD] Balance = $4,045,390.07 + Two years later;Added $37,500 per month with total gaining 6% YIRCM = New balance of $4,639,275.83.

24. Age 63 withdraw;$4,639,275.83 - 15%[$695,891.37 DD] Balance = $3,943,384.46 + One year later;Added $37,500 per month with total gaining 6% YIRCM = New balance of $4,225,152.42.

25. Age 64 withdraw;$4,225,152.42 - 20%[$845,030.48 DD] Balance = $3,380,121.94 + One year later;Added $37,500 per month with total gaining 6% YIRCM = New balance of $4,051,184.05.

26. This person now has $4,051,184.05 at age 65. Keep in mind that your money will stay in the bank continuing to gain that 6% interest past age 65. Over a 55 year period using a retirement calculator you would be able to get 659 Monthly withdrawals in the amount of $20,992.10 and one final withdrawal of $20,972.06. We are not done yet. This person stll have their various insurance policies from their account if they choose to have them plus a bank fee(BF).

So $20,972.06 - $500[Insurances] - $10[BF] = $20,462.06 per month or $245,544.72 a year. With an average lifetime salary of $516,127.66 your monthly payment would be about 47.57% of this person's average salary. If you paid a lump sum for your healthcare credit then you would get $20,972.06 - $10[BF] = $20,962.06 per month or $251,544.72 a year. That would be about 48.74% of your average salary.

All 25 withdraws from the age of 18 to 65 added up to $4,559,980.95. This person paid a life time FHT of $10,512,360. So not only did this person paid less FHT but the difference is $5,952,379.05 life time FHT. Remember, there is still $4,051,184.05 left over in this account. Subtract that amount from the difference and that means your total life time FHT was dropped down even more to just $1,901,195.

Example 4 with a self employed person

This person worked part time off and on from age 18 to 21 managed to have earned with interest $22,345.12 in their account at age 21. This person then worked self employed and has averaged $40,000 a year. Under the new tax this person put 20% a year or $8,000 a year into their URHB account and has gained a rate of 6%. Healthcare credit cost $1,990 a year and $10 a month bank fee. They made a few withdraws from time to time. Here's how this person used their account;

1. Age 21 withdraws;$22,345.12 - 10%[$2,234.51 DD] Balance = $20,110.61. Two years later;Add $500 per month with total gaining 6% YIR = New balance of $35,383.85.

2. Age 23 withdraw;$35,383.85 - 15%[$5,307.58 DD] Balance = $30,076.27. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $55,659.74.

3. Age 26 withdraw;$55,659.74 - 15%[$8,348.96 DD] Balance = $47,310.78. Four years later;Add $500 per month with total gaining 6% YIR = New balance of $87,156.75.

4. Age 30 withdraw;$87,156.75 - 10%[$8,715.68 DD] Balance = $78,441.08. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $113,536.97.

5. Age 33 withdraw;$113,536.97 - 15%[$17,030.55 DD] Balance = $96,506.42. Four years later;Add $500 per month with total gaining 6% YIR = New balance of $149,659.28.

6. Age 37 withdraw;$149,659.28 - 15%[$22,448.89 DD] Balance = $127,210.39. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $171,898.25.

7. Age 40 withdraw;$171,898.25 - 15%[$25,784.74 DD] Balance = $146,113.51. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $194,519.24.

8. Age 43 withdraw;$194,519.24 - 10%[$19,451.92 DD] Balance = $175,067.32. Four years later;Add $500 per month with total gaining 6% YIR = New balance of $249,470.05.

9. Age 47 withdraw;$249,470.05 - 15%[$37,420.51 DD] Balance = $212,049.54. Four years later;Add $500 per month with total gaining 6% YIR = New balance of $296,455.56.

10. Age 51 withdraw;$296,455.56 - 10%[$29,645.56 DD] Balance = $266,810. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $338,954.38.

11. Age 54 withdraw;$338,954.38 - 10%[$33,895.42 DD] Balance = $305,058.94. Four years later;Add $500 per month with total gaining 6% YIR = New balance of $414,622.99.

12. Age 58 withdraw;$414,622.99 - 15%[$62,193.45 DD] Balance = $352,429.54. Two years later;Add $500 per month with total gaining 6% YIR = New balance of $409,960.38.

13. Age 60 withdraw;$409,960.38 - 15%[$61,494.06 DD] Balance = $348,466.32. Three years later;Add $500 per month with total gaining 6% YIR = New balance of $436,670.91.

14. Age 63 withdraw;$436,670.91 - 15%[$65,500.64 DD] Balance = $371,170.27. One year later;Add $500 per month with total gaining 6% YIR = New balance of $400,231.02.

15. Age 64 withdraw;$400,231.02 - 20%[$80,046.20 DD] Balance = $320,184.82. One year later;Add $500 per month with total gaining 6% YIR = New balance of $346,100.90.

16. This person now has $346,100.90 at age 65. Keep in mind that your money will stay in the bank continuing to gain that 6% interest past 65. At Age 65 get 659 Monthly withdrawals in the amount of $1,793.40 and one final withdrawal of $1,779.47. So $1,793.40 - $90[Insurances] - $10[BF] = $1,693.40 per month or $20,320.80 a year. With an average income of $40,000 throughout the course of your working life your monthly payment would be about 50.80% of your average salary. If you paid a lump sum for your healthcare credit then you would get $1,793.40 - $10[BF] = $1,783.40 per month or $21,400.80 per year. That would be $53.50% of your average salary. If you have the new insurance then the insurance company may ask for a lump sum payment to keep your insurance intact for life.

Using just 15 withdraws from the age of 21 to 65 they added up to $479,518.67. If you average that out over the 44 year working period that comes up to $10,898.15 per year. So this person put $8,000 a year for 44 years and that adds up to $352,000 and had your insurance deducted from your account. The interest of 6% made it possible for this person to get back all of their money plus $127,518.67. This persons life time FHT would be $290,400. Subtract the $127,518.67 and it drops their life time FHT to just $162,881.33. This person still has $346,100.90 left in their account at age 65. That means their entire FHT has been erased as well.

With the new tax structure in place it is possible that no matter how much your salary is over the course of your life you could end up paying no FHT at all. Even if your making $1 million dollars a year in salary. Take a look at this extreme example if someone got their first job making $1,000,000 a year in salary. If you look up at the scale towards the top of this page the employer at that level is paying that person $257,500 per year into their account. When you calculate the 6% interest compounded monthly over a 17 year period with no withdraws there would be about $7,579,752.49 in that person's account. At the same time this person is paying $445,000 a year in FHT. Over the same 17 year period that person would have paid $7,565,000 FHT. The interest just made it possible to erase even that person's entire FHT burden and from there they too would be getting a boost that helps erase all other taxes as well.

You can make your withdraws however you like just understand that you get one withdraw per calendar year and a grand total of 25 withdraws from age 18 to 65 so use them wisely. You can choose to take more cash before age 65 and get a smaller monthly payment or make less withdraws and get a larger monthly payment. The choice is yours so you must decide what is best for you. Just remember that the more withdraws you make from your account the less will build up just like any savings account. You can make withdraws from your account and set up additional investment opportunities for yourself on your own with any private bank or investment firm.

Under this formula structure you will be living on your own money you earned through work all of your life. You would be 120 years old before your account runs out of money on the monthly payments. Any portion that is left over in your account when you die before the age of 65 will be converted into a monthly payment the act same ways monthly payments go out to you when you retire. Who ever inherits your private bank account that the money goes in to will get those payments and be responsible for how the money is paid out based on that person's instructions.

Self employed or sole proprietors will add money to their own account 20% and enjoy a 6% annual rate. They also will get credit for what they paid in to Social Security and Medicare and pensions if they are under 65. Plus all the options to withdraw money is open to them as well. At 65 they will draw a steady monthly payment until they die. Everyone on the old Social Security system will be paid by the URHB just as always.

No one government can change the taxes that the employer pays for benefits since it is a universal tax. It would need to be voted on by all the people with a majority vote in order to make any changes to the tax. Any changes would have to be approved by 50 governors with a 4/5 majority or 40 votes in order to make any changes to the employer tax code and signed in to law by the president. If a president veto's the motion then to over ride the veto the governors would need 42 votes to pass any changes. The people will have the right to tell their governors what they think before the votes are taken.

Since your tax money is being fed back to you through your employer there would also be very little for the IRS to do since a payroll style tax is in place and the new URHB Account is basicly returning your money to be invested for retirement. The IRS will have less responsibility as they would become employees of the new URHB tax division and only be handling taxes that self employed and sole proprietors would owe as well as dividends would generate and making sure that the employer put the right amount of money into peoples account as well as dealing with the employers new payroll tax.

Since the money for college can come from the URHB and so many other State and Federal programs can be eliminated we can also reduce the Federal Department of Education. The Federal Department of Agriculture can also be eliminated because the URHB will handle disaster releif for farms while food stamps would be no longer needed for the majority of people. We can also eliminate the department of energy and turn our nuclear weapons over to the Department of Interior. People will continue looking for new alternative energy with the money they will save from less taxes.

All money spent on government subsidies will be ended as well as money the Federal government was paying into Medicaid and Chip. All money left over from unemployment will be dumped into the new bank. All federal grant money to individuals will be ended. End lettermarking (Congressional slush fund for pet project without the limited accountability or public information that came with earmarks). If a state has to declare a state of emergency then they can qualify for a low interest loan to start the rebuilding process. The federal government will be banned from borrowing money from the URHB.

If an employer hires an immigrant with a Temporary Employment Visa(IWTEV) they will still have to pay the same rate to them both in minimum wage and the universal tax as well but there would be a special tax placed on the money they recieve. A 40% total tax would be taken out for immigrant healthcare. An example would be like this;

Salary $1,250.00 - 75%[$937.50] = Employer pays $312.50 - 40%IHT[$125] = $187.50 to IWTEV.

If an employer is caught hiring illegal immigrants or undocumented workers and paying them under the table to avoid paying the Universal Tax then there will be a new penalty set up.

* For first offenders, there will be a $20,000 to $30,000 per illegal employee.

* For second offense, the fine is $30,000 to $45,000 per illegal employee.

* Three or more offenses can cost an employer $45,000 to $60,000 per illegal employee.

* If they continue to show a pattern of knowingly employing illegal immigrants then that offender would face additional fines and up to 5 years in jail.

A new card with a picture State ID will replace your old social security number for identification. Your new social security number will be your bank transfer number.

The Universal Retirement Healthcare Bank will be insured fully by the Federal Treasury Department with Debt Free Treasury Notes so you are guaranteed to get your money. Employees can get disability insurance from the insurance companies. More on that from the link below.

NEXT